fha gift funds limit

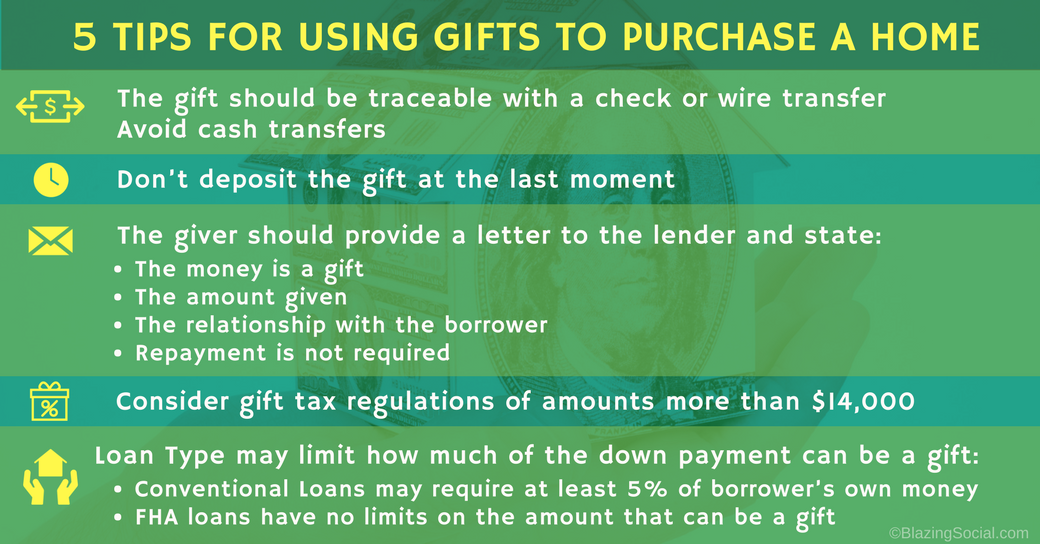

Your donor must send your lender a mortgage gift lender accompanied by a paper trail to back it up. When a borrower applies for an FHA home loan a down payment is required for all transactions.

Your Guide To Using Gift Funds For A Down Payment

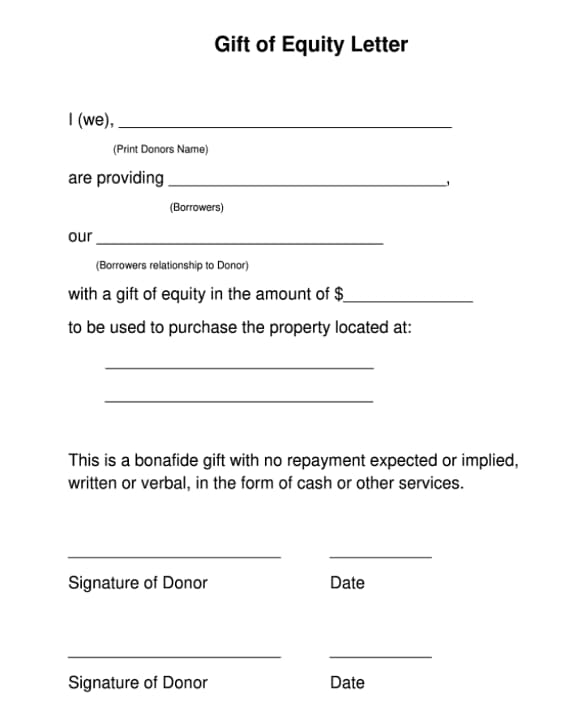

Specify the dollar amount of the gift.

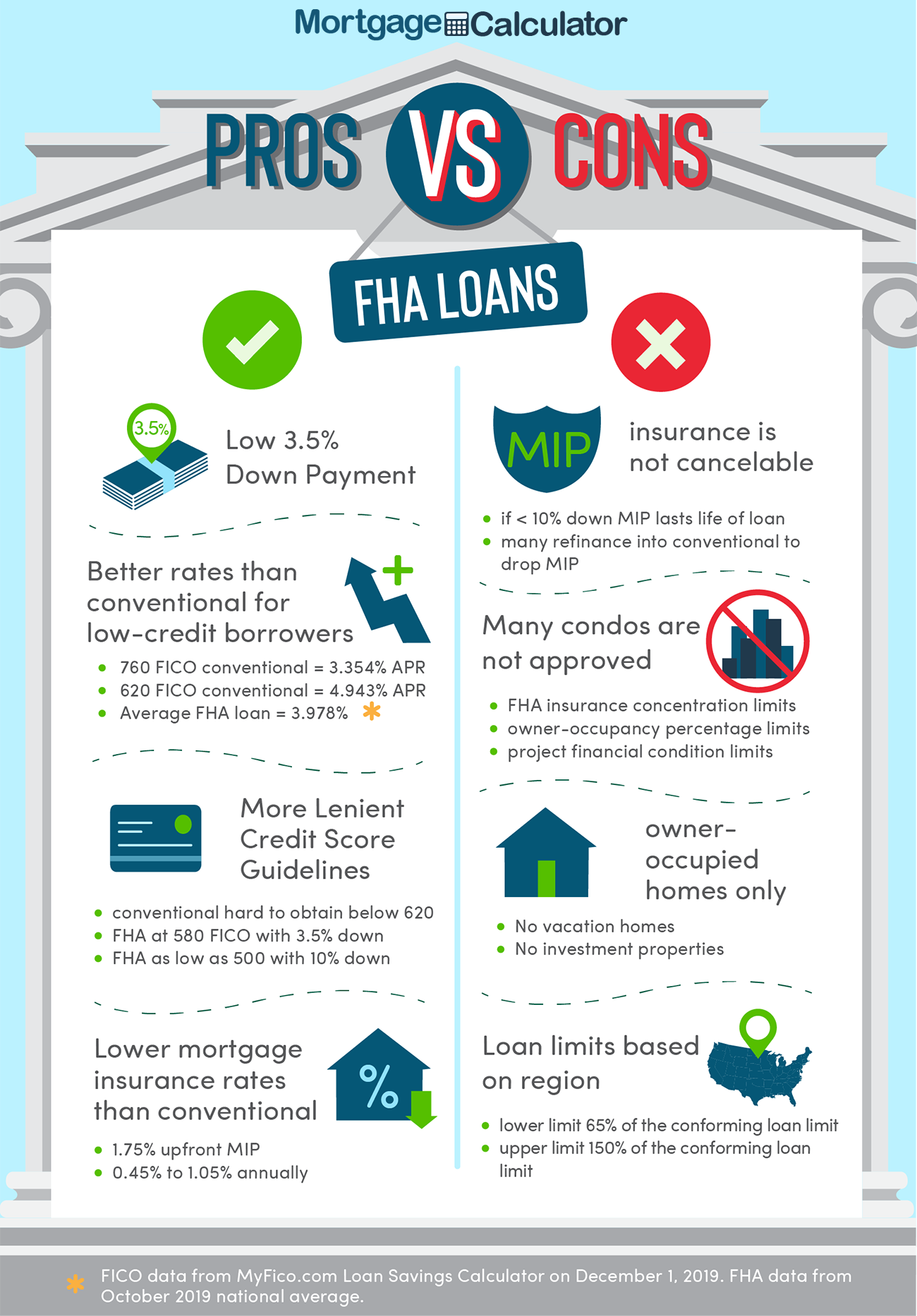

. Documentation Required for a Gift Money. Thats more than enough to cover a down payment of 35 percent which is required by the FHA. By accepting a gift of equity credit the.

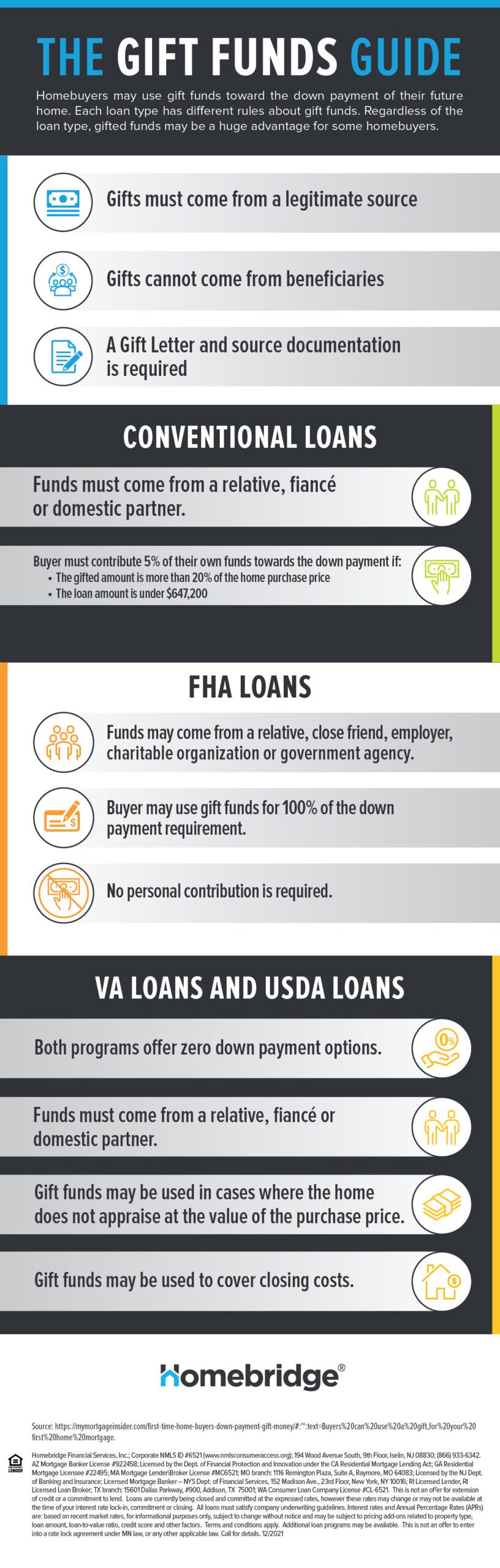

According to HUD 41551 Chapter Five. Its worth noting that the lender is allowed to offer the borrower closing cost assistance as long as the aid does not exceed 6 of the sales price and stays within the total 6 limit. The gifted funds must be sourced and seasoned and cannot be borrowed by the donor.

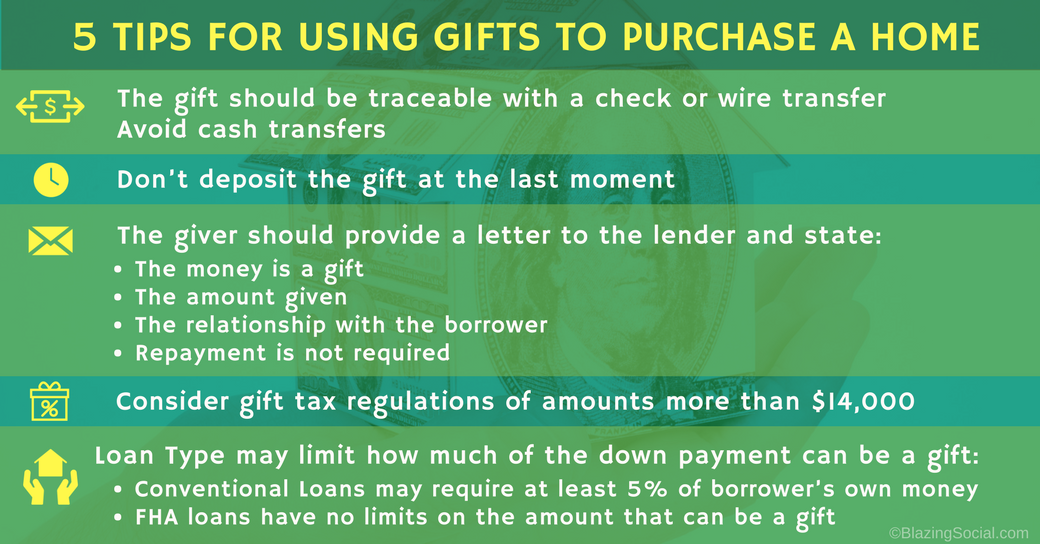

Freddie specifically allows wedding gift funds and doesnt limit eligible donors to family members Donors Not Related to Borrower. The dollar amount of the gift. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower.

This gives the buyer instant equity of 130000. The portion of the gift not used to. This could mean that buyers essentially can purchase a home with no cash down payment thanks.

The date the funds were transferred. If you are applying for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient. Gifts must be evidenced by a letter signed by the donor called a gift letter.

Virgin Islands also have even higher limits. Provide executed gift letter. Being this close to the end of the year the gift-giver may want to consider withholding 15000 or 30000 if married of the gift for January so as to avoid wasting their.

A minimum borrower contribution. However the FHA program allows you to obtain the downpayment through a gift. Any donation money must be documented by a gift letter signed by both the donor and the borrower.

Gift of equity 35 down payment. Unlike VA home loans FHA mortgages do not have a zero-money-down option. Gift Funds Already Received.

LTV CLTV or HCLTV Ratio Minimum Borrower Contribution Requirement from Borrowers Own Funds 80 or less One- to four-unit principal residence Second home A. Gift Funds-Down payment funds can be gifted from a relative spouse or a domestic partner. If you have applied for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that.

Most home buyers who use FHA come up with at least 35 percent down from their own funds. One- to four-unit principal residence Second home. Agency Eligible Donor Personal Gift Funds and Gift of Equity.

The gift letter must. Due to the higher costs of construction Alaska Hawaii Guam and the US. According to the IRS gift tax exclusions in 2022 any down payment gift below 16000 does not have to be reported.

The short answer is yes in 2019 the minimum required down payment for an FHA loan which is 35 can be gifted from a family member a friend an employer or some other approved. Minimum Borrower Contribution Requirement from Borrowers Own Funds. Provide executed gift letter.

Beyond that amount the funds must be reported on the donors gift tax. In order to establish whether a particular gift of down payment money is permitted we have to examine what the FHA describes as a bona fide gift.

Closing Costs And Gift Limits Arizona Mortgage House Team

2022 How To Use Gift Funds For Fha Loan Closing Costs Fha Co

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Gift Letter

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Can I Use Gift Money For My Fha Home Loan Down Payment Fha News And Views

Using Gift Money To Qualify For A Home Loan

Gift Letter Document Gift Funds For Fha Or Conventional Loans

Fha Down Payment And Gift Rules Still Apply

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan

A Guide To Gifts Of Equity Rocket Mortgage

Fha Gift Funds How Can I Use Them To Buy A Home

Using Gift Funds To Buy A Home Homebridge Financial Services

Fha Gift Funds Guidelines 2022 Fha Lenders

Mortgage Down Payment Gift Rules Who What Why A Letter